what is suta tax texas

Below is a chart with the current wage base and starting rates for each respective state. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

Historical Texas Tax Policy Information Ballotpedia

SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages.

. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025. Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes. Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631.

Assume that your company receives a good assessment and your. 10 rows Texas law sets an employers tax rate at their NAICS. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax.

Each state has its own limit for the wage base subject to SUTA taxes. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax.

An employers SUI rate is the sum of five components. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. The states SUTA wage base is 7000 per.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. Who pays Suta in Texas. General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training.

The amount of the tax is based on the employees wages and the states unemployment rate.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Unemployment Insurance Cost Facts Every Texas Nonprofit Should Know First Nonprofit Companies

Tac Tac Unemployment Compensation Group Account Fund

Paying Your Nanny Legally In Texas The First Milestones

Unemployment Benefits Comparison By State Fileunemployment Org

The Complete Guide To Texas Payroll Taxes 2022

Texas Workforce Commission Hogg Foundation For Mental Health

3 11 154 Unemployment Tax Returns Internal Revenue Service

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel And Lodging

State Payroll Tax State Payroll State Employment Tax Payroll Tax

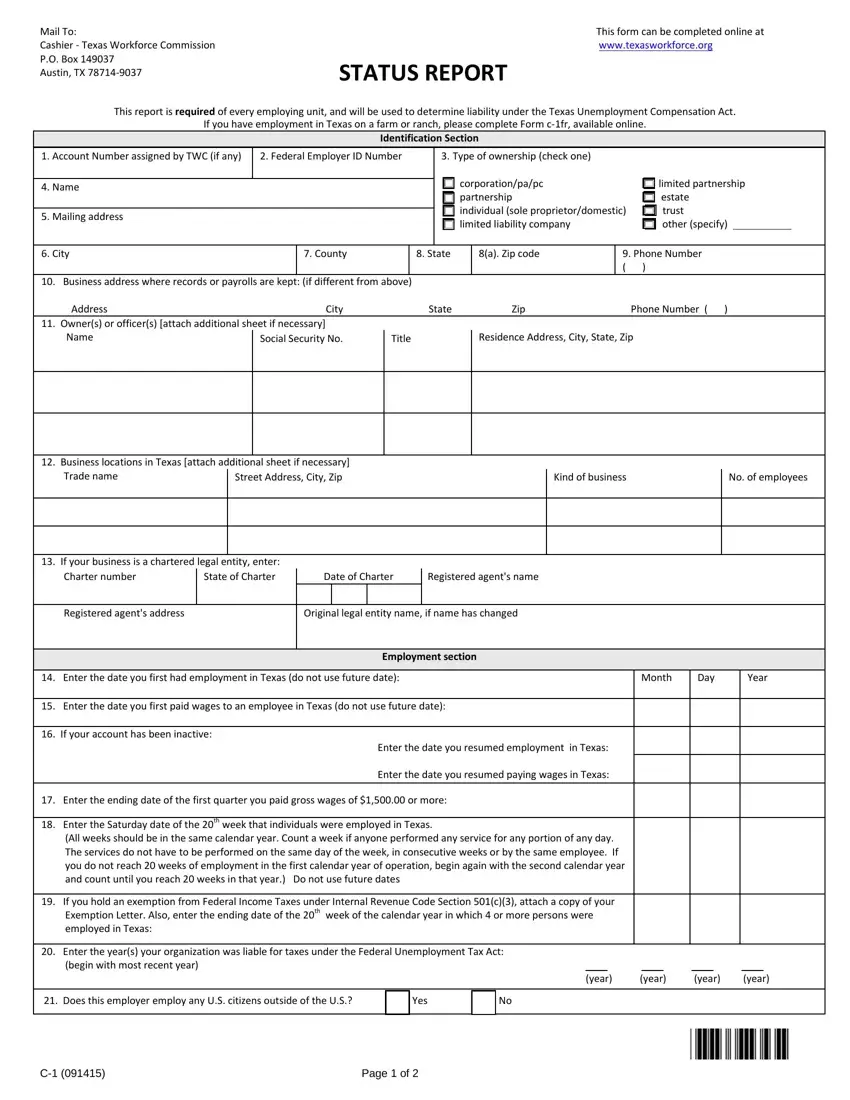

Texas Workforce Commission Report Pdf Form Formspal

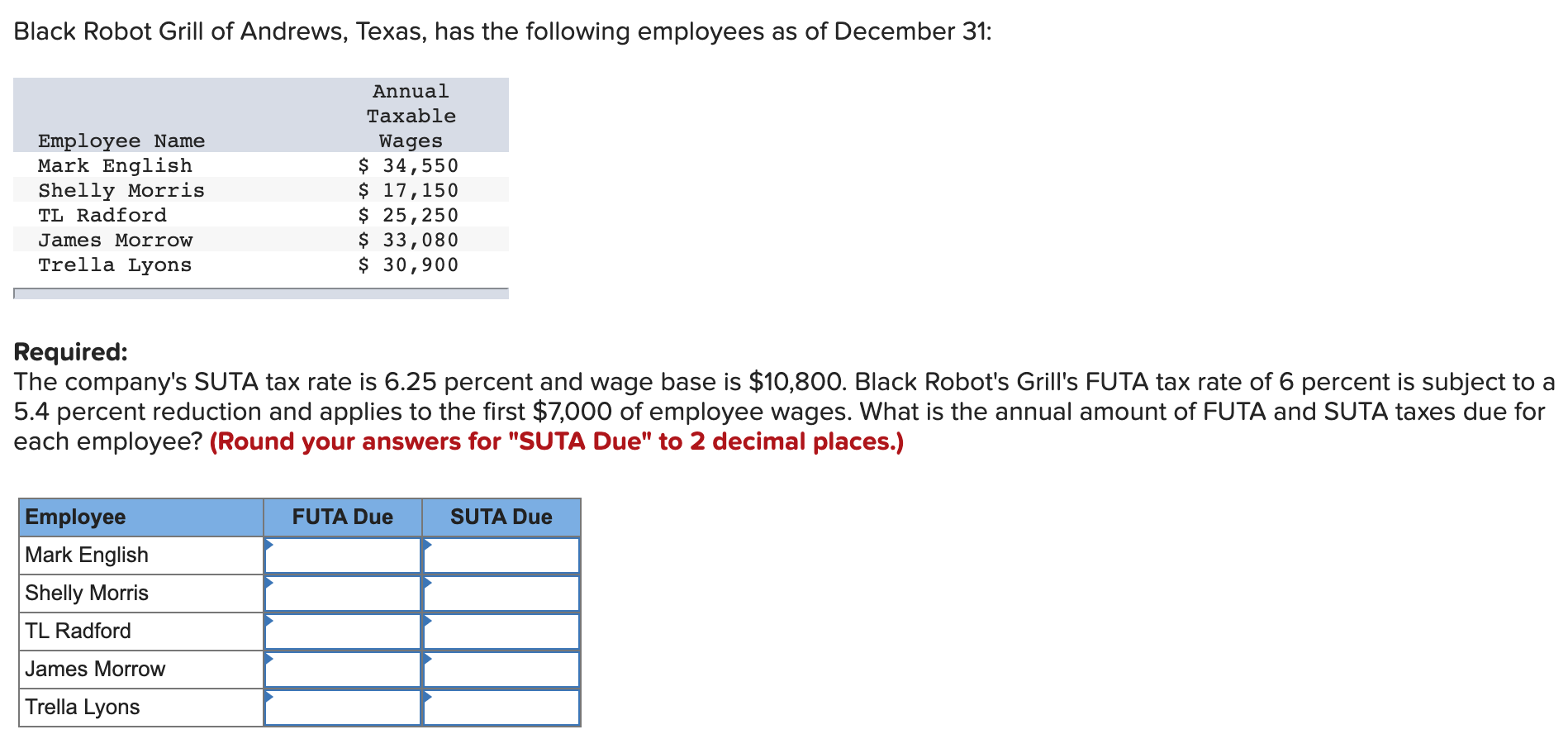

Solved Black Robot Grill Of Andrews Texas Has The Chegg Com

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

Texas Workforce Commission S Unemployment Tax Services Logon

Eligibility Benefit Amounts Texas Workforce Commission

Tax Relief Notification Texas Workforce Commission

Texas Workforce Commission Lowers Employer Tax Rates For 2020 Corridor News